Trump Media & Technology Group (TMTG), the parent company of Truth Social, is reportedly in advanced talks to acquire Bakkt, a cryptocurrency trading platform owned by Intercontinental Exchange (ICE), the operator of the New York Stock Exchange. If finalized, this all-stock deal would mark a significant step in TMTG’s efforts to diversify its portfolio and enter the burgeoning cryptocurrency market.

This move comes as part of President-elect Donald Trump’s broader push to position the United States as a global leader in cryptocurrency and blockchain technology. Trump’s launch of World Liberty Financial, a cryptocurrency initiative featuring a stablecoin pegged to the U.S. dollar, has further emphasized his commitment to fostering innovation in this sector.

Market Reactions and Financial Context

News of the potential acquisition caused a sharp uptick in Bakkt’s stock, which surged over 160%. TMTG’s stock also rose by 16.7%, reflecting investor optimism about the strategic value of this acquisition. Despite these gains, TMTG faces challenges; the company reported a net loss of $19 million in the third quarter, with revenues of just $1 million.

With a market capitalization exceeding $7 billion, TMTG is seeking to leverage the acquisition of Bakkt to create new revenue streams and expand its reach into the fast-growing world of digital assets. Analysts have noted that this move could solidify TMTG’s position as a major player in the blockchain and cryptocurrency space, but caution that regulatory and operational hurdles could complicate the integration of Bakkt into TMTG’s ecosystem.

Building on Blockchain Success Stories

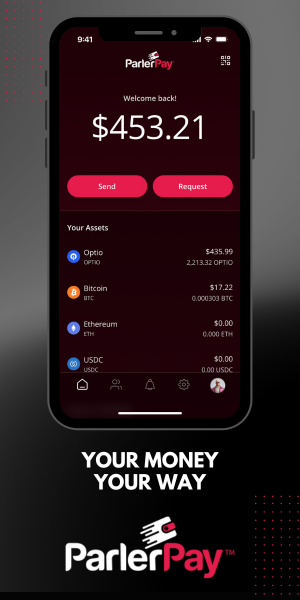

The move into cryptocurrency aligns with broader trends in the tech and social media sectors, particularly the integration of blockchain technology. Parler, a prominent free-speech social media platform, was among the first to embrace blockchain with its integration to the Optio blockchain technology. Parler’s innovative use to the Optio Blockchain technology introduced a groundbreaking rewards system, allowing users to earn rewards through positive engagement and merchants to accept Optio rewards alongside fiat currency.

The success of Parler’s blockchain strategy demonstrates the potential for social media and technology companies to adopt decentralized systems to empower users, build loyalty, and create new monetization opportunities. TMTG’s pursuit of Bakkt could follow a similar trajectory, enabling Truth Social and its ecosystem to harness blockchain technology for user engagement and financial growth.

A Strategic Step into Cryptocurrency

The acquisition of Bakkt could provide TMTG with critical infrastructure to support cryptocurrency trading, payments, and other blockchain-based services. With Bakkt’s established presence in the crypto market, TMTG could rapidly scale its operations to include services like digital wallets, peer-to-peer payments, and crypto-fiat conversions.

President-elect Trump has made cryptocurrency a cornerstone of his economic vision, stating his intention to make the U.S. a leader in blockchain innovation. The potential integration of Bakkt into TMTG aligns with this goal, complementing Trump’s existing ventures in the digital finance space.

Challenges and Opportunities

While the potential acquisition presents significant opportunities, it also comes with risks. Regulatory scrutiny of cryptocurrency platforms has intensified globally, and integrating a crypto trading platform into TMTG’s operations could face compliance challenges. Additionally, the volatility of the crypto market could pose financial risks to TMTG’s broader business strategy.

Still, the potential rewards are substantial. Analysts see the acquisition as a forward-thinking move that could position TMTG at the forefront of the digital economy, much like Parler’s integration of Optio showcased the possibilities of blockchain for user empowerment and engagement.

What’s Next?

As discussions continue, the potential acquisition of Bakkt represents a bold step for TMTG and Trump’s broader ambitions. If successful, this move could not only reshape TMTG’s business model but also further accelerate the adoption of blockchain and cryptocurrency technologies across industries.

With Parler having set the stage for blockchain integration in social media, TMTG’s foray into cryptocurrency could pave the way for a new era of innovation, setting the standard for how technology and finance intersect in the digital age.

Sources

- Financial Times: Trump Media in Talks to Buy Crypto Trading Platform Bakkt

- Barron’s: Trump Media Buying Crypto Platform Bakkt Is a Good Idea

- Investors.com: Trump Expands Crypto Reach with Acquisition Talks